I don’t trade exotics. I only trade CSPs and CCs. I don’t like leveraged trades, I don’t like speculative trades… and I especially don’t like companies with no profits (they’re doing something wrong, IMO).

So some of these issues apply to the stock MSTR (MicroStrategy). Here is my reply.

A price drop is almost a certainty. It’s ridden up then dropped just around earnings the last few times.

The real question is what price do you prefer: $137.80 per share or $163.84 per share? A lot depends on where you see the price falling to.

It also depends on the rest of your PF, your PF risk management skills, and your analysis of the company.

I personally wouldn’t be looking to buy at a top like that knowing in a few weeks I could be buying at a cheaper price. But this is a company I don’t know anyway, and if I had a big enough PF, I’d probably stagger a trade into, if I was hell-bent on purchasing this.

But then I probably wouldn’t: It’s got all the flags of punt.

- recent run up in price;

- current froth in the price;

- no profits to speak of; and

- a fairly large short share; so clearly a bunch of peeps are betting on it going down;

- the insiders seem to be selling as well.

So… good luck on that! If you do it, watch it like a hawk. Be prepared to wait, though.

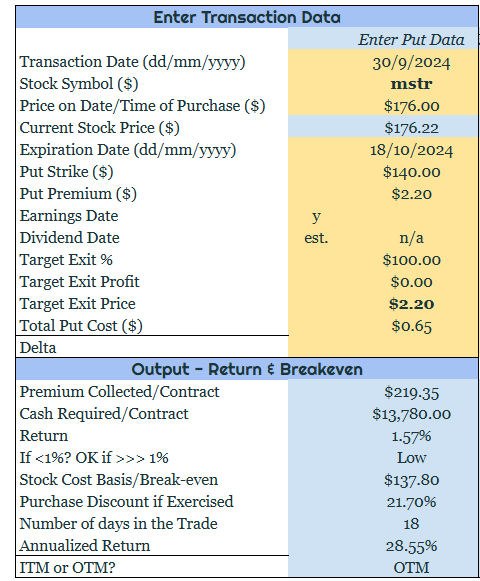

If I calculated correctly, I make your annualized return 28.5% or thereabouts on the CSP.

Now, if you know that the price is going down, and you’re set on a price closer to $160, you could buy at the market and sell a CC for $160 with the probability it will be called away. So you’d make $16000 -$17600+$2315 or $715per contract. The risk is that it goes below $152.85 but it will get called away since it’s ITM. Your upside is limited to that amount.

Did I get that right?

IANAFA. DYODD.

Anyways, for my own personal amusement I created the following spreadsheet.