It’s time to rebalance the PF as we head through the Christmas rally. Thoughts?

Well, Nokia hasn’t done terribly well. I’m going to stick on my rule: no less than $5 stocks. It’s down 20% since I bought them. I’m exiting 5 of the positions and rolling one, if I can.

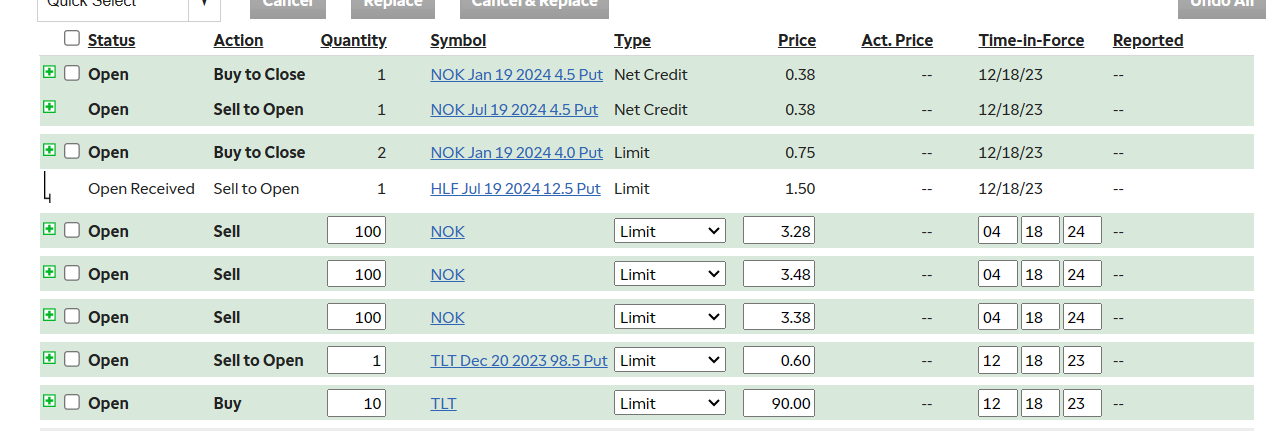

- I’m exiting 2 puts to another position and adding a little equity to the pot.

- I’m rolling the $4.5 as far as I can in 2024.

- Then I’ll exit the position step by step: 3.28, 3.38, and 3.48 or thereabouts. Hopefully, that will give me some upside of about $78 on the total position. Not very successful.

TLT is a new one. I’m not even sure that my account allows me to buy this so I’m testing a couple of trades, with no expectation either of them will fill. But if the orders are accepted, then it could be a useful way to trade for a higher dividend, esp. since I am unable to buy so many other funds.

Results: So far, TLT was down .7% so of course it filled at a much higher price. And it was in the money. I rolled it out and down by 7 days and 50c. I’ll probably have to roll it again sometime next week. I probably should have spent more time observing this trade. The $90 purchase of 10 shares would never have filled. So I nixed it.

I tweaked NOK by 2c on the first rung, but on going to bed it still hasn’t filled. Out of 9 orders, only 2 have succeeded/canceled so far.